Undervalued Indian art mkt turns bullish

Amrita Sher-Gil’s work fetches Rs 37.8 cr in auction on July 13; India accounts for a meager 0.3% of global art market size of Rs4.75 lakh cr

image for illustrative purpose

The art market witnessed many new records in the last year. Two works of Gaitonde were lapped up in quick succession, in September 2020, at Rs 36.8 crore and Rs 35.5 cr, putting to rest all doubts about the impact of the pandemic on the Indian art market, with respect to top quality works.

Then in March 2021, Gaitonde bettered his own record to give Indian art a new all-time high of Rs39.98 cr. Interestingly, it was on July 13 only, we had much loved, but relatively lesser followed artist Amrita Sher-Gil (1913-1941), whose body of works is quite limited on account of her short lifespan, garnering a stupendous Rs37.8 cr, giving her the added rare distinction of being the only artist outside the Bombay Progressive Artists' Group to see above Rs25 cr. All this supports the view that the Indian art market is all set to see the return of the Bull.

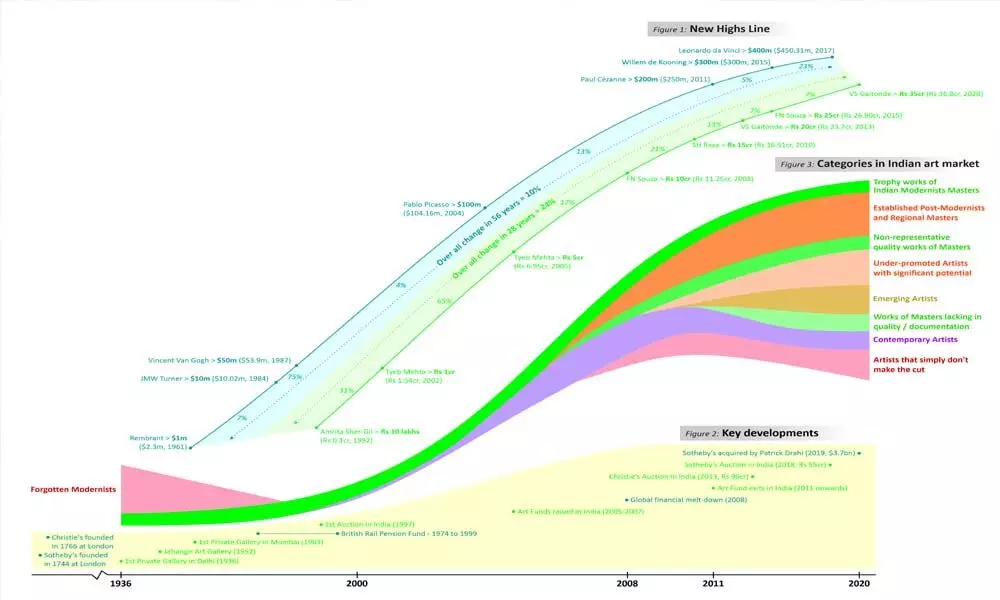

To put into perspective, the Indian art market, has witnessed an above average growth rate of 24 per cent over the 28-year period (1992 to 2020), as evidenced from the New Highs Line from the ArTrends Report by Aura Art - which saw the highest priced painting of Indian art going up from Rs 10 lakhs (incidentally again Amrita's work) to Rs 36.8 cr.

This analysis was also published in a pathbreaking report Trendonomics 2021. Satish Narayann, Director & Practice Head, Ambit Global Private Client (GPC), says, "it has been a pleasure to work with Aura Art - especially for this thought leadership piece in Trendonomics 2021, which was extremely well received by our clients. A testimony to the many hours of research is that Ambit GPC recently won an award for 'Best for Investment Research, India' at Asiamoney Private Banking Awards 2021. Aura Art has generated value addition in relation to building and managing art collections for our clients - not that I expected otherwise, having myself been initiated by Rishiraj into my personal art collection journey."

The Indian Art Market has intrigued many an onlooker for long. While perspectives abound on the oscillations of the market, no clear effort has been made to see the long-term trend. No art indices are currently maintained. While it is possible to get very granular and evaluate growth in pricing of specific works of each artist, we believe a broader indicator of the market always signifies a better long-term trend.

"Hence, we have tried to plot the highest milestone prices achieved by successive paintings over more than a 50-year period. The reasoning behind choosing this parameter is quite simple - in any market, the highest absolute value paid for any single unit always provides a significant psychological resistance, till it is breached. And then we have also attempted to see if the growth rates align with the trend, over various time periods of achievement of subsequent new price benchmarks", Rishiraj Sethi, Director, Aura Art Development told Bizz Buzz.

The Indian Art Market, sized at close to Rs1,500 cr, is relatively undervalued at 0.3 per cent of global market at Rs4.75 lakh crore. In contrast, the Chinese Art Market surged to nearly 20 per cent of the Global Art Market in last decade. However, the uptrend in Indian Art Market is quite consistent. While an Amrita Sher-Gil Village group was lapped up for Rs 10 lakh in 1992, Tyeb Mehta's stunner Celebration breached the Rs1 cr mark in 2002 (was acquired for Rs 1.54 cr). The next few years were the defining period for Indian art, with galleries expanding, secondary market (auctions) coming in play and increasing participation by domestic and international collectors, resulting in a 65 per cent CAGR when Tyeb's Mahisasura attracted an astounding Rs 6.95 cr in 2005. This was quickly displaced by Souza's Birth (Rs 11.25 cr, 2008), at a growth rate of 17 per cent pa. Even the global financial meltdown in the 2008 did not dampen the growth rate, with Raza's Saurashtra breaching Rs 15 cr (Rs 16.51 cr, 2010), again averaging a handsome 21 per cent CAGR. Even in the International art market, one sees a very interesting trend of successive highs, averaging at 10 per cent over the 56-year period (for the highest priced painting to move from USD 1m to USD 450m).

The international art market is at least 250 years old, if one were to take the formation of Sotheby's (1744) and Christie's (1766) as a relevant starting point, although museums were set-up as early as 1677 and many galleries/dealers would have sprung up before these auction houses. The very fact that these auction houses have flourished for centuries is a bearing on the long-term sustenance of the art industry. Interesting to note that as recently as June 2019, Sotheby's was acquired by French-Israeli telecommunications entrepreneur Patrick Drahi, in a deal worth $3.7 billion. This purchase returns the only publicly traded major auction house to private ownership after 31 years on the New York Stock Exchange. Likewise, Christie's was acquired by French businessman and art collector Francois Pinault in 1998, at a valuation of $1.2 billion.

In comparison, the first Indian private art gallery was set up in 1936, whereas auctions started in India from 1997 onwards - although Indian art was featuring in international auctions since 1986. Pertinent to note that art funds came in India within 10 years of development of a secondary market (auction houses), as against nearly 200 years in the west. Hence, lack of depth of the market and maturity and expertise of the market participants was clearly wanting.

Thus, the International and Indian art markets have demonstrated a linear upward trend for a very long time, taking global economic hiccups in their stride.